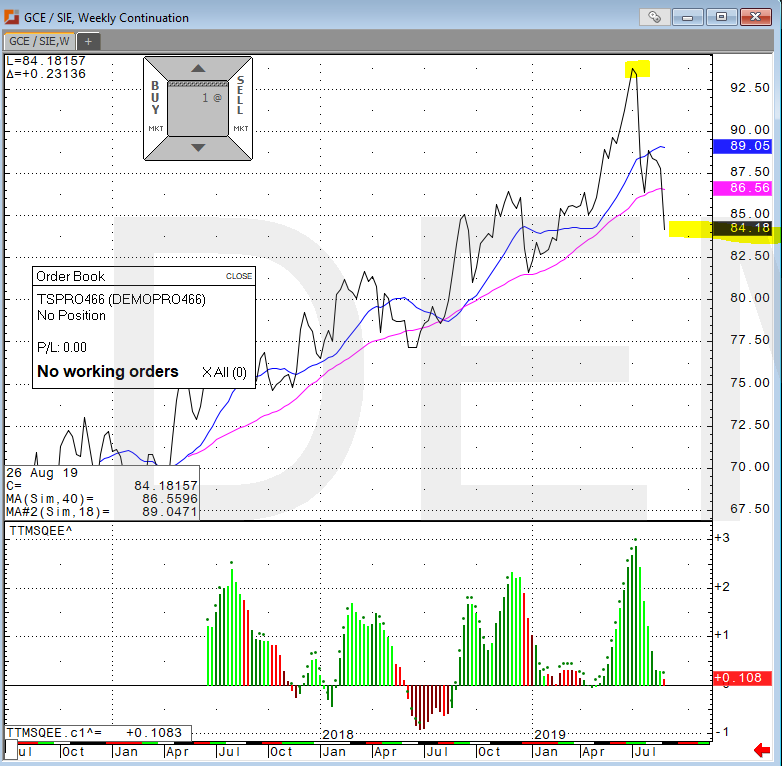

The chart below shows Gold/Silver ratio is favoring silver after hitting milt decade high. So, the moral of the story is that silver has more upside relative to gold. I would expect the spread to trade down to 60.00 area in the coming months. What I find even more interesting is that the U.S. dollar is very strong and so is silver. The U.S. Fed is struggling with pressure from President Trump and whispers of recession around the globe causing uncertainty in other investments. Silver having performed so well in this multi-month rally even with such a strong U.S. dollar could be considered very bullish indeed. There is strong chance the upcoming U.S. election season will inject further anxiety into equities causing indices to dip down even further which would support precious metals even further and could see silver go to $24.00 and beyond! Positive headlines could cause a pause in this rally but pull backs could become buying rather than selling opportunity.