Front-month March silver is trading 15.590 down 16.2 cents on the day. Silver is tracking equities this morning to the downside, as retail sales came in with the biggest drop since 2009. Stocks are shrugging off weak retail sales. The big news on the horizon is the possibility of the Friday meeting with authorities to finalize a trade deal with China. A deal between the U.S. and China will likely foster positive global growth. In short, what’s good for China and the U.S. is good for everyone.

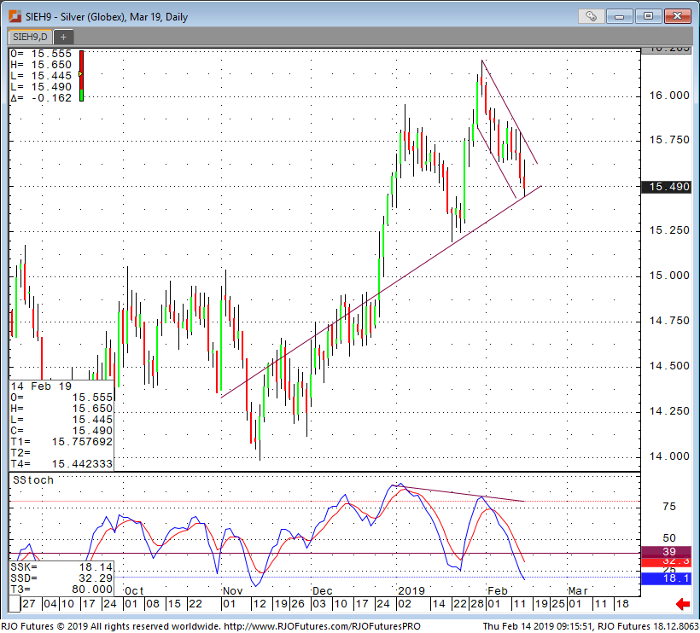

Silver/gold ratio is back to 84.14, with a recent pressure on silver as bulls exit the near-term sideway to lower price action. The chart below doesn’t convince me that the highs are permanent and additional weaknesses are possible. A close below 15.00 most likely signal near term high, otherwise we are just looking at a consolidation for more potential upside.

Silver Mar ’19 Daily Chart