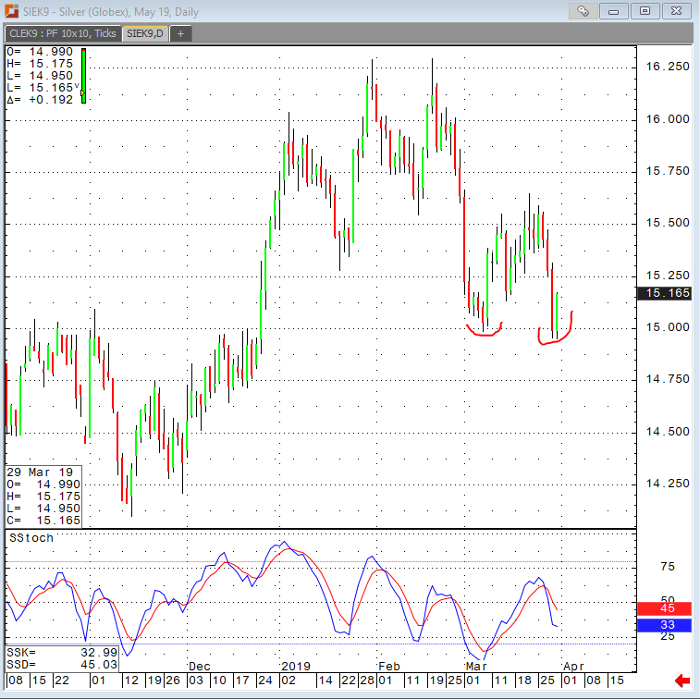

The precious metals markets of gold and silver have been showing their strength since the substantial price decline down below 15.00. Daily charts show that silver is trying to hold 15.00 support. A close below that would likely signal fresh selling interest. The U.S. dollar is relatively soft this morning, giving a much-needed lift for these markets. With the U.S. Fed holding off near term rate hike, the dollar would likely trade in consolidation resulting near term support for silver.

Silver is tracking equities as it has been the past few sessions. Technical traders should be encouraged by the bounce here but as always, the bull camp needs fresh news to sustain a continues to rally. In my opinion, the bears still have the advantage due to significant chart damage done to the market. There are always great opportunities for silver to shine for bulls in the long-term as we approach the chaos of the next U.S. presidential election, the uncertainty of Brexit, concerns of a bursting bubble in this long U.S. equities bull market, and whispers of a recession gathering volume. “The oldest and strongest emotion of mankind is fear, and the oldest and strongest kind of fear is fear of the unknown,” wrote H.P. Lovecraft, and when all else looks uncertain, and fear sets in, silver runs with the bulls.

Silver May ’19 Daily Chart