Fundamentally, President Biden just signed the 1.9 trillion dollar Covid-19 relief bill into law today. Silver is looking to benefit from the passage of the 1.9 trillion dollar stimulus package. The benefit to the silver contract will come in the form of infrastructure spending and speculative buying interest. Rest assured, other countries worldwide will take similar actions to shore up their economy and potentially drive up the silver price. The reality is that at some point in the future, the excess liquidity around the world could have a long-term impact on inflation, triggering higher price actions.

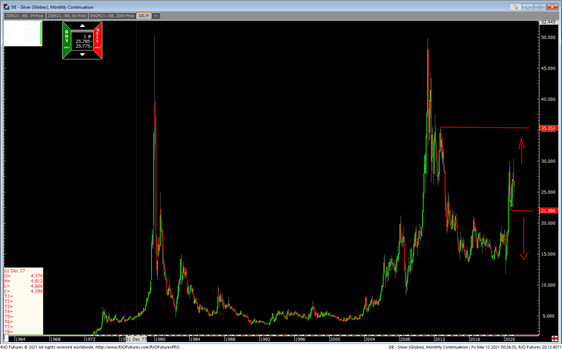

From the technical perspective, attached is the long-term silver chart worth looking at from time to time. It seems like silver will trade above $30.00 again before it trades below $20.00. Near term, silver could pop above $26.50, and trade below $25.00 could trigger a wave near $24.00. If you want to look at ideas to trade this ranging market, please let me know.