The stock market has been very volatile this week, after a large downturn last week, leaving us in the midst of one of the biggest sell-off in the last 10 years. Silver and other precious metals have been moderately quiet this week, but have held their ground from last week’s rally. Silver closed Thursday at $14.59 an ounce as investors ran to precious metals as a safe haven. The next few weeks we will see a lot of economic data coming out that could affect silver. On October 25th durable goods numbers come out, on October 26th GDP number come out, on October 29th personal income comes out, and on October 30th consumer confidence comes out. With the stock and bond markets giving off a feeling of uncertainty, one wonders, with the recent interest rate hikes and fear of further increases, if there will be a flood of money and liquidity into the metals markets.

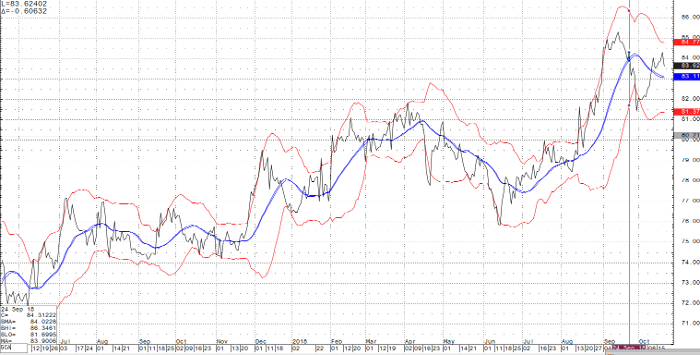

Another important factor to note, is that silver has been under-performing gold lately. In regards to the gold/silver ratio, the current ratio stands at 83.62 (see chart below). With a recent high of 85.31, it shows some resistance at the 85 level. This ratio tracks industrial production. During periods or economic growth and rising inflation, silver will generally outperform gold. In this case, silver’s under-performance could be attributed to rising interest rates. Due to the uncertainty of the overall economy and fear of rate hikes ahead, perhaps it is a good time to buy silver as we feel it has broken its downward trend.

Silver Dec ’18 Daily Chart