Metals are suffering due to a stronger U.S. Dollar index, posting an interest rate rise of .25 after the FOMC meeting that took place on Wednesday afternoon. With the economy acting strong recently and having such a great year, safe-haven markets have suffered. We have a short term negative bias from here and have our technical levels listed below:

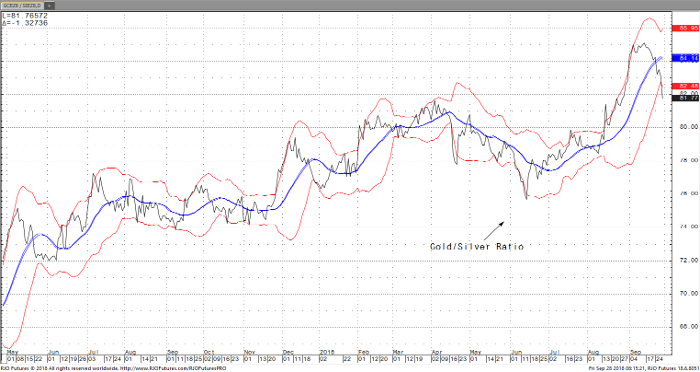

Silver had been flat on the week, however is up .22 cents this morning on a lot of talk that silver is cheap in relation to Gold. The gold/silver ratio, which is simply gold divided by silver is sitting at 82 as of Friday morning. There have only been 7 times in history where the gold/silver ratio has exceeded 80. Silver is near a trend-line breakout and could have a short-term pop, like this morning. However, we still think we need more news in the following month ahead from FOMC and we will keep a close eye on the dollar and any news of tariffs between the U.S. and China.

Gold-Silver Ratio Chart Dec ’18 Daily Chart