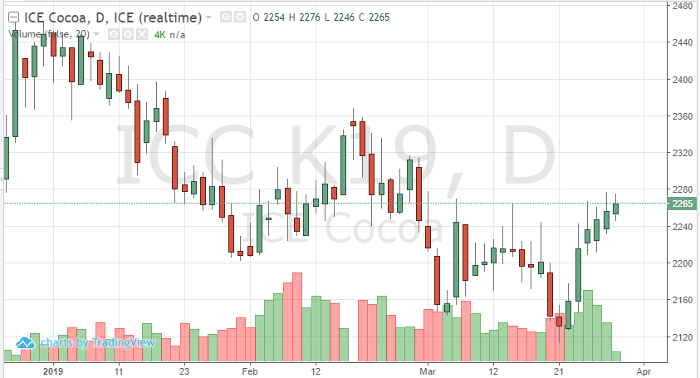

May cocoa futures have had a positive week. Short-covering and re-establishing bulls have helped the market reach its highest levels of the month. As we end Q1, traders will continue to wait for an increase in demand expectations. The COT data released on Friday’s has recently showed heavy selling and declining open interest. Technically, 2280 will be some resistance – a break and hold above this number will be needed for a push back above 2300. As we enter April, we will start to focus on the roll to the July contract. Inverted levels have been close all week between the May-July cocoa contracts. The tightness in the spread may attract longs to roll earlier.

Demand appears to be on the rise globally. Bearish supply news seems to be already priced into the market. Currencies could also help support current levels. Brexit news can also move the cocoa market at any given moment if any votes/deals break.

Technically, a continued close above the 9-day moving average along with a nice trendline forming, leading prices higher – Q2 may start off strong for the cocoa market.

Cocoa May ’19 Daily Chart