Global equity markets were mixed overnight with Pacific Rim stocks and the XETRA DAX managing to gain modestly and the rest of the world under minor pressure. The Asian economic calendar started off with a February reading for Chinese foreign exchange reserves which surprised with an increase back above the $3 trillion mark and that probably helped Asian markets track positively overnight. However, the European session started out with January German factory orders which fell by the biggest monthly amount since 2009, and that might have started out European and US stocks on a back foot.

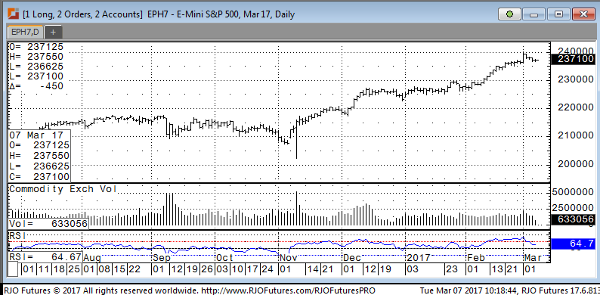

While the March E-mini S&P did not forge a lower low overnight, it has initially favored the lower half of the prior sessions range down move. As mentioned already, the offering of a replacement for the affordable care act looks to spark another round of political sniping and perhaps a temporary drift away from pro-growth policy efforts. It does appear as if stocks in general are reacting negatively to positive US data and that isn’t surprising considering the markets expanding expectations toward the rate hike next week