Bullish developments in several areas should continue to provide underlying support, so coffee is unlikely to fall sharply from its current price levels in front of the holiday weekend. A weaker Brazilian currency played a key role in coffee finishing the day in negative territory as that may encourage brazils farmers to market their remaining near-term supply to foreign customers.

The international coffee organization said that this seasons global Arabica exports through the end of July came in at 82.63 million bags which compares with 78.89 million at the same point last year. Brazil’s green coffee exports last month came in at 172,242 tonnes which compares with 191,124 tonnes during August of 2020.

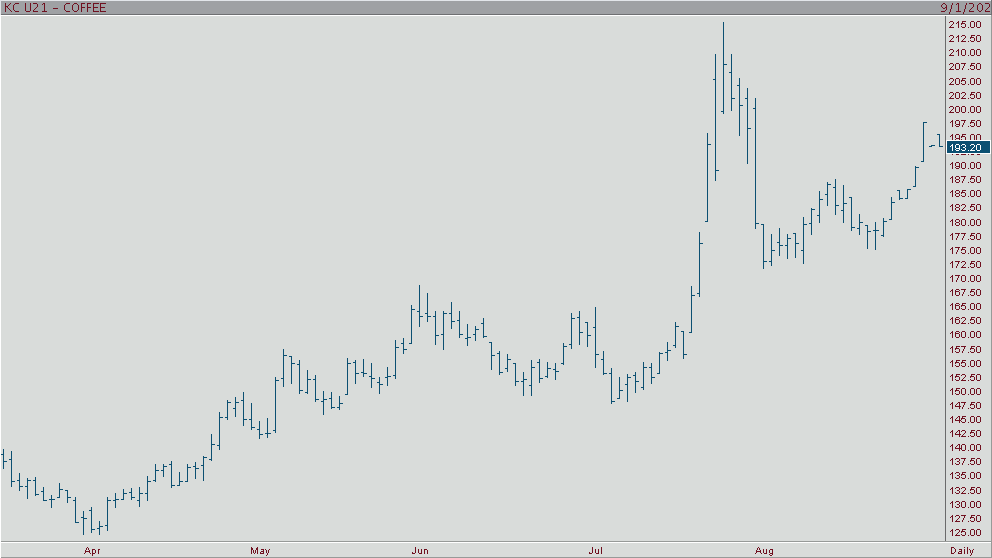

Rising stochastics at overbought levels warrant some caution for bulls. A positive signal for trend short term was given on a close over the 9 -ay moving average. Near term upside objective is 20120. The next level of resistance is around 19810 and 20120, while the first support comes in at 19310 and 19110.