The S&P 500 continues to climb the wall of worry ignoring every bit of news being thrown at. The market has been rallying over the last few months on hopes the Fed will lower rates in late July. It’s all but a sure thing they will lower 25 basis points, but the Fed is starting to face some serious problems. Economic data in the past few weeks has been very good. It started with last week’s employment number that came in hotter than expected and this morning’s much better retail sales that shattered expectations. Now, if the Fed continues to move forward and lowers rates, which I believe is a mistake, how much higher does the S&P go? Well the market has already priced this in, so we can see the classic “buy the rumor (which we have seen the last few months) and sell the fact.”

It’s most unusual that the Fed will lower rates with asset prices making new all-time highs. Another problem is the Fed only has 225 basis points to work with. Why would you start lowering now? Well that’s a good question. My best hypothesis is that the Fed is not being run as an independent agency like they should. They are being bullied by constant pressure from White House. Most traders are confused at recent price action as yesterday was the lowest volume day we have seen since last November right around Thanksgiving. Traders who are contrarian by nature see these low volume rallies as a good indicator to possibly fade this rally, but as the rally continues in the face of fantastic economic news, the confusion level is very high. A good indicator to watch to watch is the Russell 2K, which has underperformed the S&P, Nasdaq and the Dow and shouldn’t be ignored as the next bear market is might be here quicker than most people think.

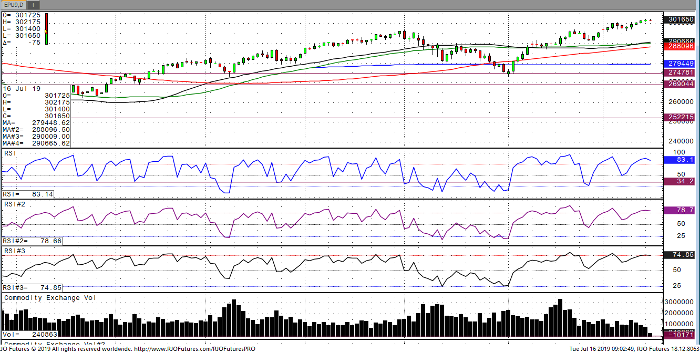

E-Mini S&P 500 Sep ’19 Daily Chart