Coming into this morning, the S&P continues to make gains on decent earnings and is ignoring other risks such as the stalemate in U.S. and China tariffs. There was an unfortunate terrorist attack in Sir Lanka over the weekend, and the rumor that China will be reluctant to continue stimulus to combat economic weakness, which is quite surprising because we have seen severe weakness in China early in the first quarter of this year. There are some in the investing world that maintain that China fudges their numbers so this could be interesting going forward. This week should be critical for the stock market as this week is the busiest in terms of earnings, with Boeing reports tomorrow. Boeing has been a major laggard in the last month due to the horrible plane crash of the Max. Boeing is also one of the top weighted stocks in the Dow so tomorrow is critical for all indexes but especially the Dow.

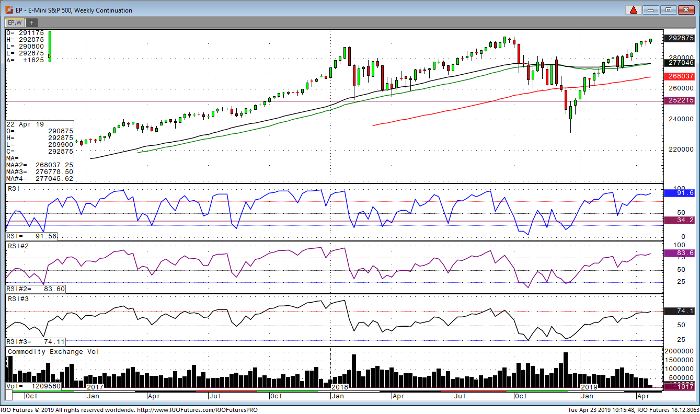

Looking at the technicals in the S&P, the market is overbought but continues to move upward. 2944.75 contract high is the next level on the charts. Currently the S&P is trading at 2925 up 12$ on the day. On the downside, I see support at 2890 and if we get a close below that level I believe 2850-2852 could come into play rather quickly. In terms of economic reports this week, I see Friday as the big day as GDP comes out at 7:30 central. The street is looking for 1.8 vs 2.2 last month. Should see some volatility after the number if expectations are missed. Have a great Tuesday and happy trading.

E-Mini S&P 500 Weekly Chart

If you would like to learn more about S&P 500 futures, please check out our free Trading E-mini S&P 500 Futures Guide.