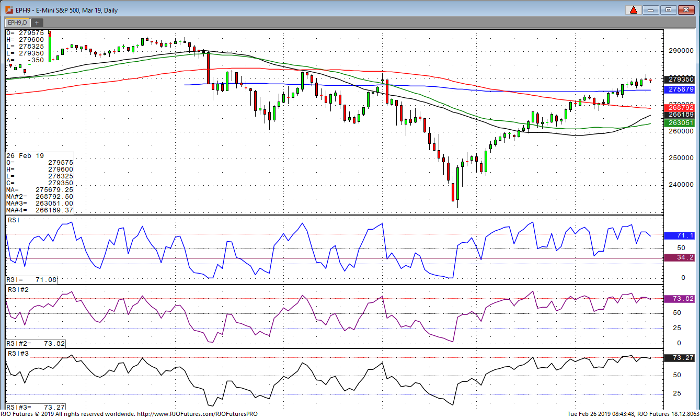

Coming into this morning, the S&P 500 is currently down $5 at 2791 and traded in a tight range overnight with a high of 2796 and a low of 2783. Factors that can move the S&P today include Fed Powell testifying in front of congress on interest rate and the outcome of President Trump’s summit with Kim Jung Un. I don’t believe this summit will be a market mover, but traders should pay attention to anything that comes out on tape. Technically, the S&P is still poised to extend gains if 2756 continues to hold which is also the 200-day moving average. Going forward I still believe the best trade is to buy dips as the market continually leans on a truce with China to end the tariffs. Any news that comes from tariff talk seems to put a bid in the market, so it is somewhat dangerous to hold shorts in the stock market for very long. When we have down days in the market, Trump tweets that things are going great with China and seems to squeeze the shorts. Again, traders should be on guard for market volatility at 8:45 Central today as Powell will be speaking. Is he going to sound hawkish or dovish? Stay tuned. He speaks shortly.

E-Mini S&P 500 Mar ’19 Daily Chart