SEP 10-Yr T-NOTES

The extent and impulsiveness of the market’s decline following 27-Jun’s short-term mo failure discussed in that day’s Technical Blog is impressive and defines 14-Jun’s 127.08 high as one of major importance and possibly the end or upper boundary of a major correction within a new secular bear market in T-note prices. From a very short-term perspective overnight’s continuation of this slide leaves yesterday’s 125.16 high in its wake as the latest smaller-degree corrective high the market now has to sustain losses below to maintain a more immediate bearish count. Its failure to do so will confirm a bullish divergence in short-term momentum, stem the slide and expose what we’d believe to be is just a slightly larger-degree and interim correction ahead of eventual resumed losses. In this regard 125.16 is considered our new short-term risk parameter to recent non-bullish decisions like long-covers and cautious bearish punts.

On a daily close-only basis above, the market’s gross failure to sustain Jun’s gains above former key 126.06-area resistance-turned-support and subsequent break below 23-May’s 125.18 larger-degree corrective low breaks AT LEAST the uptrend from 10-May’s 124.15 low. But given the 3-wave structure of the broader recovery attempt from 13-Mar’s 122.07 low however, it’s quite possible that 14-Jun’s 126.295 high defined the END of upper boundary to a major bear market correction. We anticipate further trendy, impulsive price action lower with 19-Jun’s 126.145 initial (1st-Wave) counter-trend low the level this market needs to recoup to negate such a count. In this regard 126.15 is considered our new long-term risk parameter to a new bearish policy.

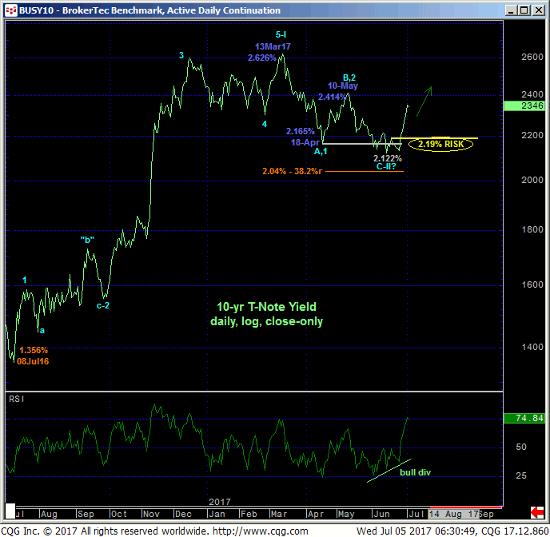

Arguably underscoring a broader bearish count in the contract is the fact that Mar-Jun’s relapse attempt in actual 10-yr yields below failed to retrace even a Fibonacci minimum 38.2% of the entire 5-wave rise in rates from 08Jul16’s 1.356% low to 13Mar17’s 2.626% high. This chart shows a nice bullish divergence in momentum that defines 14-Jun’s 2.122% low as one of importance and potentially the END of a 3-wave and thus corrective decline from the market high that warns of an eventual resumption of 2016-17’s rate rise that preceded it. A failure below 19-Jun’s 2.19% initial counter-trend high is minimally required to threaten this call for higher rates.

From an even longer-term perspective shown in the weekly chart of the contract below, it’s not hard at all to envision the past 3-to-6-month recovery attempt as a mere correction against the backdrop of 2016’s broader downtrend. This market could waft around within the 122-to-127-range for months and remain within the context of our call for a new secular bear market in the contract and eventual new lows below the pivotal 122-handle. And the deeper into the middle-half of this range the market gets, the poorer the risk/reward merits of directional exposure will become. Per such traders are advised to wait for corrective rebounds to the upper-1225-handle for a preferred risk/reward bet from the short side. In the meantime and until or unless the market recoups our short-term risk parameter at 125.26, further losses should not surprise.

JUN18 EURODOLLARS

The market’s break below more than a month of support around the 98.39-area obviously exposes at least the intermediate-term trend as down and identifies that now-former 98.39-area support as a new key resistance area. 22-Jun’s 98.455 high serves as the latest smaller-degree corrective high and new short-term risk parameter the market is required to recoup to negate a bearish count.

The technical construct of this market is, not surprisingly, virtually identical to that detailed above in the T-notes with the recovery from 14-Mar’s 98.05 low to 18-May’s 98.515 high a 3-wave affair as labeled in the daily chart above. Left unaltered by a recovery above at least 98.46 and preferably 98.52 and our new long-term risk parameter, this 3-wave recovery is considered a corrective event ahead of an eventual resumption of 2016-17’s major downtrend that preceded it. The fact that 16-Jun’s 98.45 weekly high close was just a couple basis points away from a Fibonacci minimum (98.47) 38.2% retrace of the entire 2016-17 decline from 99.12 to 98.075 would seem to reinforce a count that calls the past month’s highs the end or upper boundary of a correction within a new secular bear market.

In sum, a bearish policy and exposure from the 98.35-to-98.38-area are advised with strength above 98.46 required to defer or threaten this count enough to warrant its cover. In lieu of such 98.46+ strength further losses are expected with former 98.39-area support considered new near-term resistance.