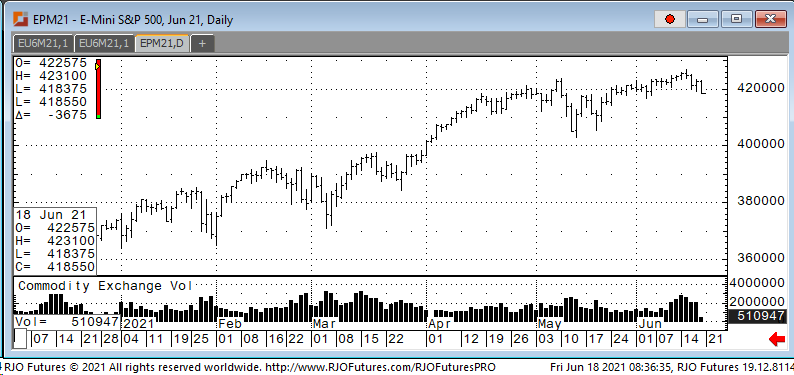

U.S. stock futures dropped Friday, putting the Dow on pace for its worst weekly performance since the end of January. Futures tied to the Dow Jones Industrial Average fell 0.8%. The Blue-chip index fell 1.9% this week, leaving it poised for its worst showing since it retreated almost 3.3% in the last week of January. This morning also saw the S&P index down .07%. If it continues the benchmark index could see an end to a three-week streak of gains. Nasdaq-100 futures traded 0.5% lower, due to a drop in large technology stocks at the opening bell. Traders are also not as optimistic after Federal Reserve Bank of St. Louis leader James Bullard said on CNBC that he expects the first Fed increase in late 2022, due to the fact that they have faced more inflation than it expected, and policy makers need to be nimble, he added. But it will take more Fed meetings to organize the debate over reducing its bond-purchase program.

Support today is checking in at 418500and 416500 with resistance 423000 and 424500.