U.S. stock indexes were trading lower today as inflation data was released along with some earnings of high-profile companies. The (PCE) personal consumption expenditures in June showed the price of goods and services rising 0.4% in June, slower than the may number of 0.5% and lower than the expected number of 0.6%. The PCE is an inflation measure that the Fed watches very closely. The second month in a row of decelerated price growth gives them some room to pull back from their emergency market support. Amazon released earnings this morning with revenues topping $100 billion for the third straight quarter, but it missed analysts estimates for the first time in three years. Chevron, Exxon and Caterpillar showed profits from cost cuttings during the pandemic.

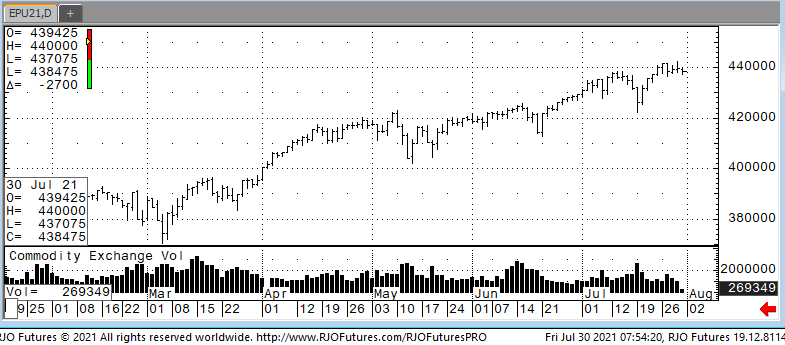

Support today is 438500 and 436000 with resistance showing 443000 and 444500.