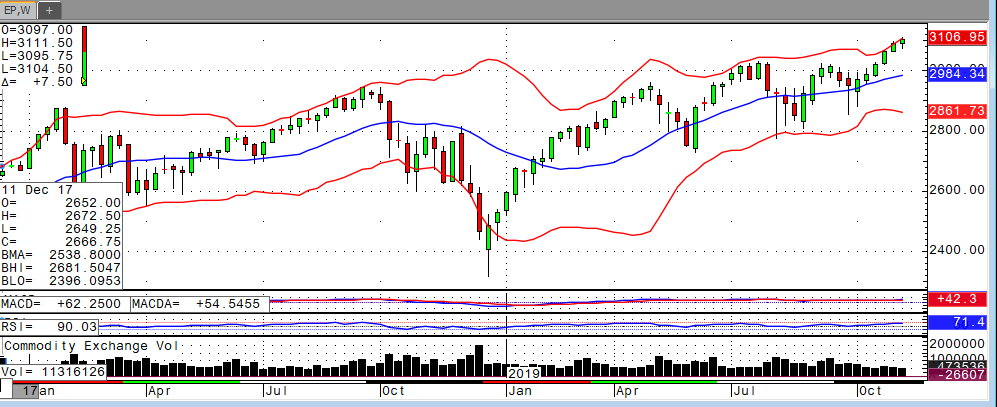

U.S. equity futures continue to ride the bull train Friday morning, aided by better-than-expected retail sales (0.3 % m/m vs. 0.2% expected). While industrial production missed expectations, market bulls are shrugging off that news. The technical pattern resembles a steady ‘melt-up’ in stock futures, similar to the pattern we saw at the beginning of the year. While economic data is improving slightly, the recent numbers are nothing to write home about. Furthermore, the trade situation seems to be on the back-burner, and earnings growth has been less-than-stellar. This grind higher in stocks is attributed to positive US economic sentiment and technical strength. If we see a close above 3120 in the S&P, the sky is the limit. The bullish bias remains so long as the index trades north of 3074. Shorting stocks at all-time highs is always tempting, but it has proven to be detrimental over the last 10 years. This trend looks to continue unless a geopolitical event shakes the market.