Futures losses continued this morning adding to Thursday’s tech-driven selloff, while traders were watching a mixed group of bank earnings and a larger than expected drop in U.S. retail sales. Friday’s economic data came in much weaker than expected, adding to the current sell off. U.S. retail sales fell 1.9% in December month-to-month, far exceeding the estimate of a 0.1% drop making it the largest drop since February 2021. The November number was also downwardly revised to 0.2% compared to the 0.3 percent previously reported. In Fed Governor Lael Brainard’s hearing before the Senate Banking Committee on Thursday, she suggested the central bank could begin raising interest rates — a move that would tighten financial conditions and help bring down inflation — “as soon as asset purchases are terminated.” The Federal Reserve is currently set to end its asset-purchase tapering process in March.

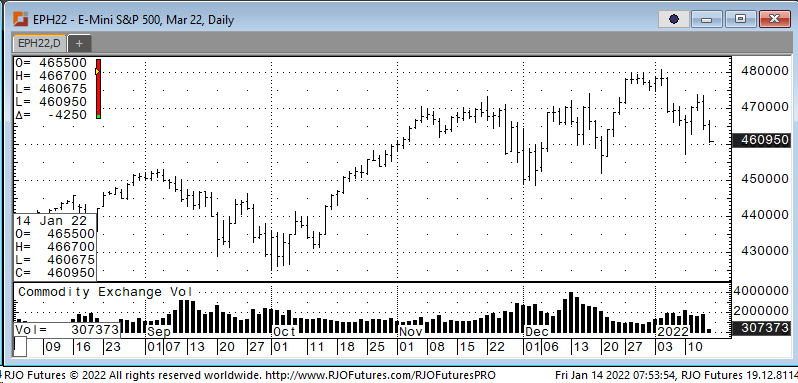

Support today is 460300 and 457500 with resistance showing 469500 and 476300.