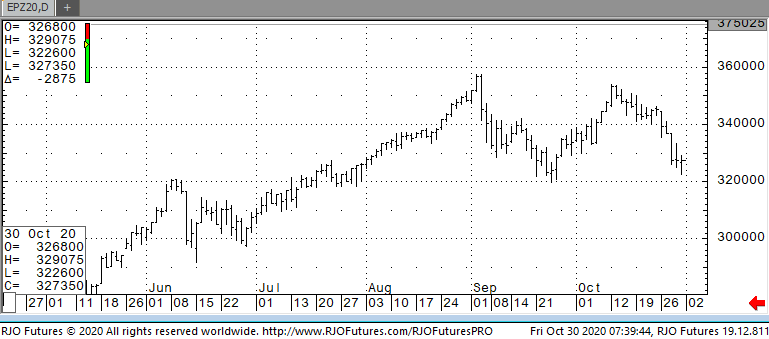

U.S. stock futures are trading lower this morning giving back gains seen on Thursday’s trading. Even with yesterday’s gains, stocks are still poised for a steep decline this week with the S&P down 4.5%, the Dow 5.9%, and Nasdaq 3%. This week’s downturn was mainly due to new coronavirus fears throughout Europe and the U.S. Germany and France has once again taken extreme measures to slow the spread with Germany even imposing a full shutdown for four weeks. In the U.S., almost all states have seen a jump in hospitalizations and deaths creating fear of another shutdown. Even if a shutdown doesn’t occur the fear is slowing spending and activities creating problems for many business sectors. This morning also showed some reports from big tech companies adding concerns to a slowing economy. Apple reported very low sales of its iconic iPhone and Twitter missed its growth estimate to name a few. This will add volatility to the market that will keep rising going into next week’s election.

Support today is 324500 and 320500 with resistance showing 333000 and 337500.