U.S. stock futures are trading lower this morning on continued fears of a global economic decline from the coronavirus. Dow Jones Industrial Average futures are trading lower, with a loss of 95 points at the open. S&P 500 and Nasdaq 100 futures are also primed to lower open. The number of confirmed cases in China increased with over 800 new cases announced overnight. South Korea and Japan also announced new cases.

“It could be some larger players hedging against downside risk of the coronavirus spreading,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “That, on top of the Goldman call that a correction is more likely, has people on edge.”

Other economic events coming up include.

- Earnings season rolls on, with results from Deere & Co. set for Friday.

- Euro-area PMI and inflation data are also due Friday.

- Group of 20 finance ministers and central bank chiefs are due to meet Feb. 22-23 in Riyadh, Saudi Arabia, and are expected to discuss efforts to support growth amid the coronavirus threat

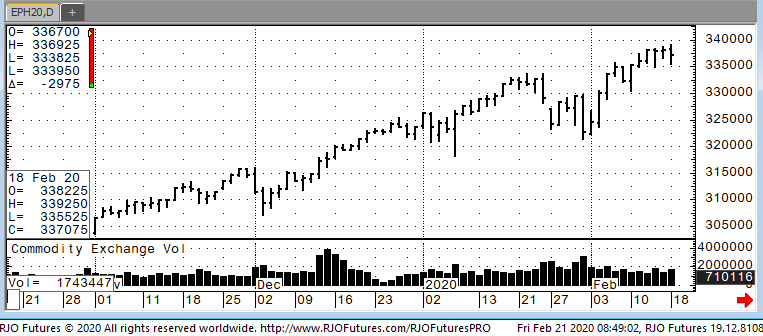

Resistance today is 339900 and342600 with support at 334000 and 331000