Stock futures rallied this morning gaining back some of the gains lost on Thursday, the worst trading day on Wall Street since mid-March. Thursdays down day, a 7% decline in the Dow, was triggered by increased coronavirus cases around the country and warnings of sustained economic losses caused by the virus shutdowns. The losses came after John Hopkins University released data that showed new coronavirus cases were rising in a handful of states, cases in Arizona have almost doubled since Memorial Day. Even with the huge drop Thursday the market was still 35% above the intraday lows seen on March 23rd. These gains were fueled by industries that would greatly benefit from an economic reopening such as retailers, airlines and vacation-based companies.

“We had gone straight up more than 30% without a real sell-off, so you’re due for one, and I don’t think it’s the worst thing in the world,” said JJ Kinahan, chief market strategist at TD Ameritrade. “As more states get back, the question becomes: Are they going to ramp up fast enough to please Wall Street? What you’re seeing is it’ll be hard to do that. Some of these stocks may have gotten ahead of their skis. When you see some of the airlines being priced at the levels they were before this all started when they say they’re going to do 60% of their business just doesn’t make sense.”

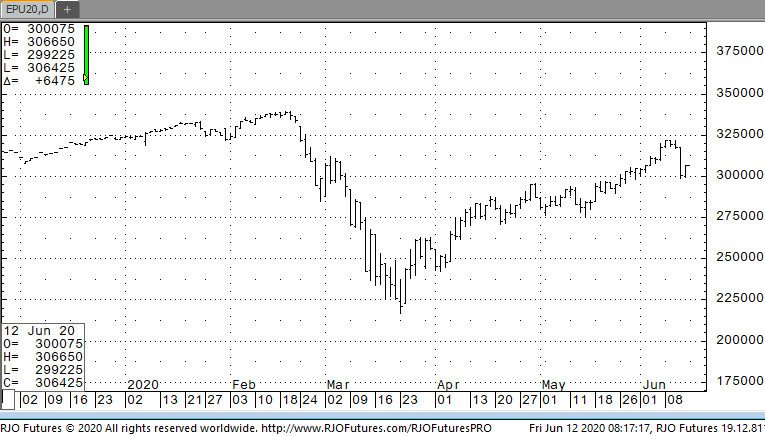

Support is checking in today at 252500 and 229500 while resistance is showing 284000 and 293000.