Volatility has kicked into full force since Sunday afternoon when Trump tweeted that he will slap additional tariffs on China this week. So, when futures opened Sunday night, all indexes were sharply lower and that continued into most of yesterday’s trade. Then, around noon, there was a headline that the premier of China was still planning on attending a meeting on Friday in Washington, so markets reversed and closed nearly unchanged. At around 3:55 yesterday afternoon, the Trump team announced that even though China’s Premier is coming to Washington on Friday, Trump is still planning to enact tariffs this Friday and the Dow Futures dropped 200 pts in 5 minutes.

The carnage has continued into today, the SP is down 44, the Dow is down 370, and and the volatile Nasdaq is 144. It almost feels that the market does not believe the rumors coming out of Washington anymore. It seems that at least once a week someone from the Trump team says negotiations are going well with China and then you get news on Sunday that we are adding additional tariffs so believing what the Trump team says going forward maybe a bit harder to believe. Traders should continue to watch for any headlines that come across the tape and should be cognizant of the expanded volatility.

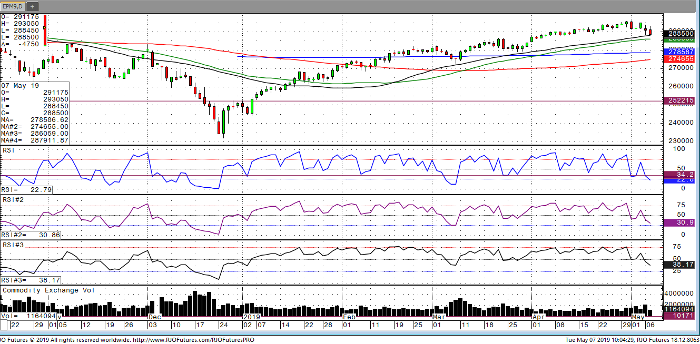

E-Mini S&P 500 Jun ’19 Daily Chart