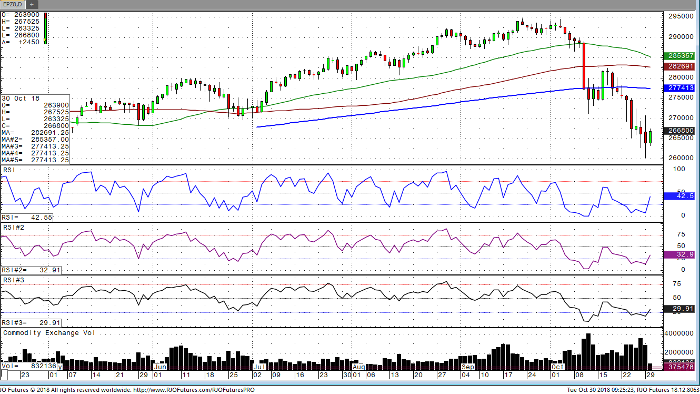

The S&P 500 has seen more volatile price action in the last few weeks than we have seen all year. All indices, Dow, S&P, Nasdaq, and Russell have entered bear markets and from what we have seen over the last few years, “buy the dip” is no longer the favored trade. Instead, traders are favoring a “sell the rally” type of strategy. In my opinion, selling the rally works wonderful in a market like this, as you might not sell the high. One can be wrong, but since we are in a bear market, the market should let you out. So, if things stay as they are, “sell the rally” is the favored strategy until proven otherwise.

As we look at the markets presently, the S&P is at 2663 up 2075 but the Fang Index is flat, meaning that APPL, Facebook, and Google are lagging, which does not bode well for the S&P as the day continues. Notable economic reports come on Friday with the monthly employment report being published. The street is looking for a gain of 190k new jobs, but the real key is wage growth. Last month, we saw a rise of 2.9% which was enough to send shock waves throughout the market as jobs are the main factor the Fed looks at as they continue the path of raising rates. Friday, the market is looking for a rise of 3.1%, which if it comes in as expected, should send both bond and equity markets south rather quickly.

E-Mini S&P 500 Dec ’18 Daily Chart