U.S. stock futures were trading lower Friday morning after a record gain in the Dow and S&P 500 as treasury yields continue to trek higher. Thursday saw the S&P and Dow make both record setting highs in intraday trading and the close with information technology and communication stocks leading the way. The S&P lost .04% with the tech heavy Nasdaq falling 1.4% while the 10-year yield rallied back to its high of the year of 1.61%, up 8 basis points over night. This increase in bond yields will put pressure on tech stocks as it reduces the value of their future profits. “Higher rates, less dovish central banks are now considered to be the single biggest threat of risk assets,” Ralf Preusser, Bank of America’s rates strategist, said in a note. With the passage of a US fiscal stimulus package and the blistering progress in vaccinations in the US, a number of key risks are falling by the wayside.”

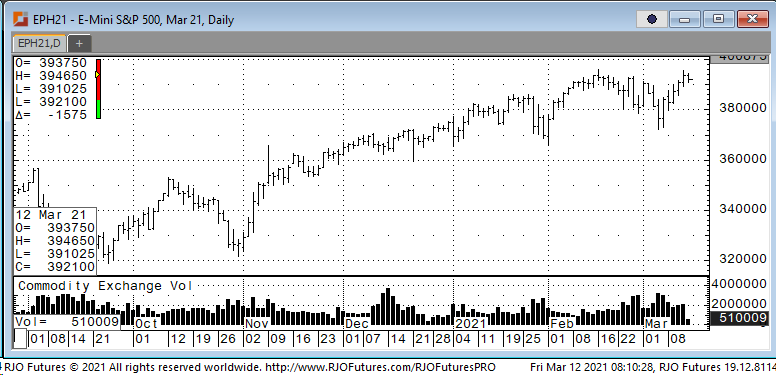

Support today is 390500 and 386500 with resistance showing 397000 and 399700.