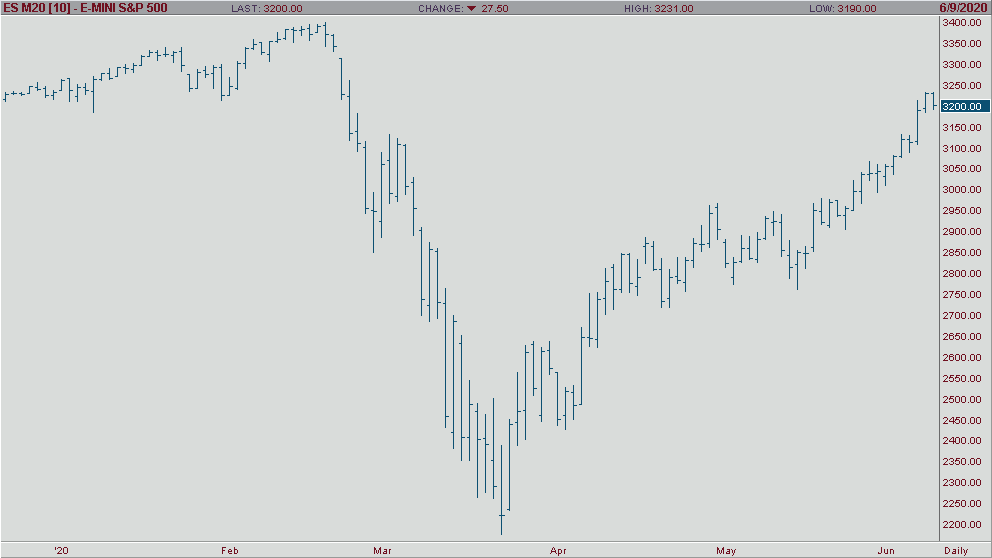

After a strong two day rally it looks like the markets are starting to slip early Tuesday morning. At open, Dow Jones futures dropped 1.3% while the S&P 500 and Nasdaq 100 lost 1.3% and .5% respectively. One of the larger culprits for the drop in the S&P was the steady decline of big name airlines like American and United which fell 6.8% and 4.5%. While we are down today, many experts expect this to be a minor hiccup, it what has been one of the quickest stock market recoveries ever recorded. The jobs number that came out Friday surprisingly showed an increase from April to May which is very welcome news. The next markers in the headlights to watch are the job openings report due out later this morning and an updated wholesale trade report.

On the coronavirus front, we are slowly moving back to normal life, or at least a new type of normal life, with more and more states reopening. Cases are continuing to slow, but we are keeping a watchful eye on open states to see if cases spike. The worldwide number currently sits at 7.2 million infected and 409,000 deaths, however infection rate and death rate slowed again this past week. We are seeing some good signs here and a potential light at the end of the tunnel.