U.S. stock futures are down this morning as investors await an address from President Trump on increased tensions between the U.S. and China which some have characterized as “Cold War” status. Losses from Thursday continued this morning, the final trading session of May, with the DJIA trading over 100 pts lower. Today’s untimed address was announced after a joint statement from the U.S., UK, Canada, and Australia condemned Beijing’s national security laws on Hong Kong. The National People’s Congress, China’s parliament, passed legislation that could greatly reduce democratic freedoms in that semiautonomous city. All this follows Trump’s efforts to pass legislation delisting some Chinese corporations from the U.S. exchanges. Also today, The University of Michigan released its highly regarded consumer sentiment survey. This index, a measurement of consumer attitudes on the business climate and spending, rose to 72.3 up from 71.8 in April which is sharply down from the 100.0 level a year ago.

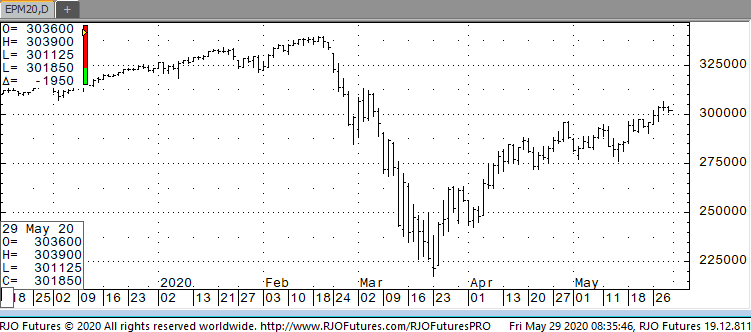

Support today is 252700 and 229500 with resistance showing 284500 and 293000.