U.S. stock futures were slightly down this morning after a positive Thursday trading session. Yesterday’s markets were higher after the Federal Reserve stated that they will ease some rules that limited banks abilities to invest in hedge funds and similar investments. This will increase their profits since interest rates were cut to almost zero from the coronavirus outbreak. Traders had a boost of confidence by some moves made by officials allowing business to reopen, but some states have seen new restrictions after a surge in infections. States such as California, Florida and Texas all have seen a huge spike in hospitalizations after aggressive reopening’s. The Commerce Department released data this morning which showed consumer spending increasing by 8.2% for the month of May. This was the largest increase recorded since 1959. April’s number showed a historical low of a 12.6 decline. On the flip side, personal income dropped 4.2% after a record increase of 10.8% in April. April is when the Fed gave stimulus checks to millions of Americans and in greatly increased unemployment benefits to fight the COVID-19 hardship.

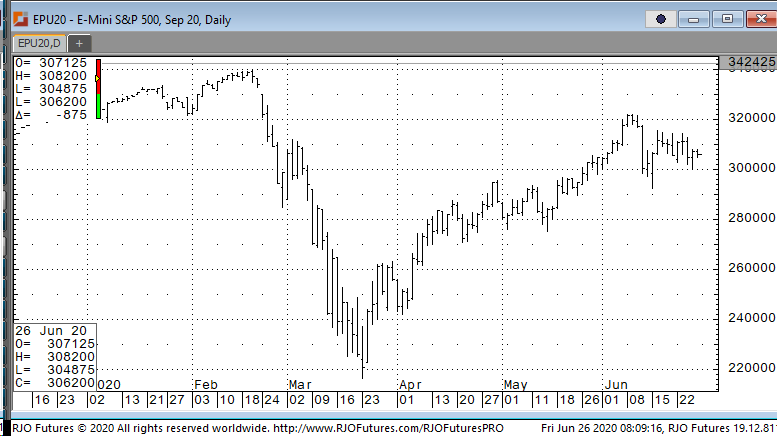

Support today is showing 302500 and 297800 with resistance at 309800 and 312500.