Stock futures are trading lower this morning after Thursday’s sell-off in tech sector as traders look past growth stocks in anticipation of a tighter monetary policy next year. Higher rates and the central bank speeding up of their asset purchase tapering has weighed heavily on the value of technology and growth stocks. Through Thursday’s close the Nasdaq composite has fallen 5% in the last month. The Fed is not the only one responding to faster inflation, Thursday also saw rate hikes from Mexico, the U.K. and Norway with the European Central Bank pledging to reduce the rate of bond purchases in the upcoming year. Europe’s largest fund manager at Amundi stated. “We see a risk of a bearish steepening of the yield curve. This reinforces our negative view on duration and is generally positive for value equites relative to growth equities.”

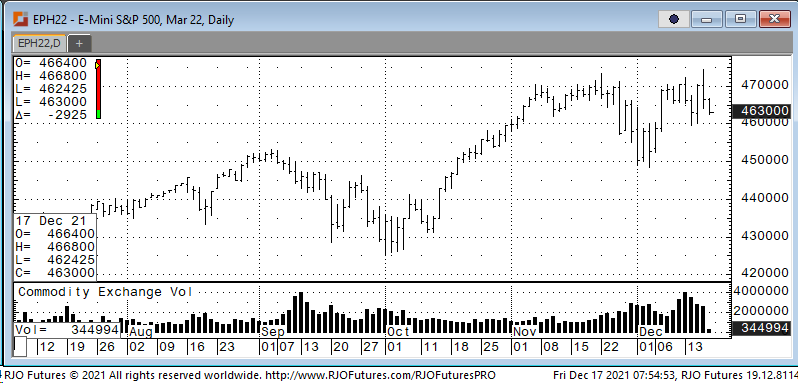

Support is checking in at 461000 and 457400 with resistance showing 471100 and 477800.