U.S. stock futures were down this morning after some negative news from Johnson & Johnson on the effectiveness of its one-shot vaccine to fight coronavirus. Also, large amounts of speculative trading from the retail sector is also causing concern across the markets with the volatility it is creating. JNJ released data this morning that their one-shot vaccine option was only showing a 66% effective rate compared to Pfizer and Moderna’s 95% effective rate for their two-shot dose. Robinhood removed some buying restrictions on stocks they had halted yesterday with the “short-squeeze” trades we have seen this week. This caused GameStop shares to double in premarket trading today after $1billion was received from said investors overnight. The thought of a continuing rise in these sorts of stocks is causing concern that it will carry over to more industries as funds will have to sell other holdings to raise cash for short positions held. It will be very interesting to see how this day unfolds.

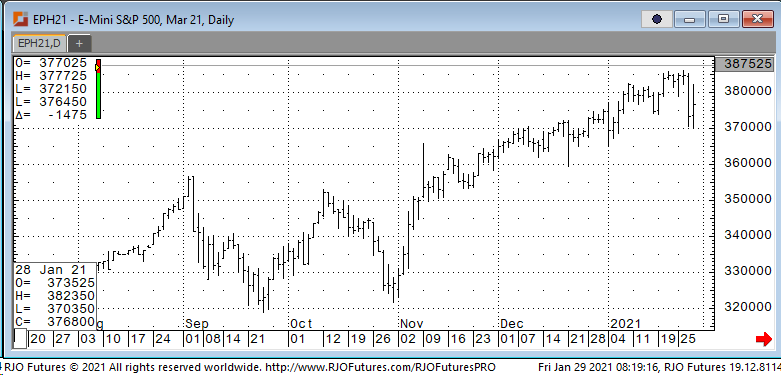

Resistance is 384500 and 389200 with support showing 372500 and 365000.