U.S. stocks were poised to open higher Thursday morning until the retail sales number and Coca-Cola’s earnings were released. Retail sales number had its largest monthly drop in ten years as the Commerce Department declared a 1.2% drop. The data was bad enough to reverse investor sentiment which was bullish on Wednesday after President Trump stated that talks with China were going very well and he hoped an agreement would be reached before the March deadline. Coca-Cola’s pre-market earnings announcement and yearly forecast also fueled the morning sell-off. Even though they met the analysts fourth quarter earnings estimate their concern for weaker than expected 2019 earnings dropped the share price by 3%.

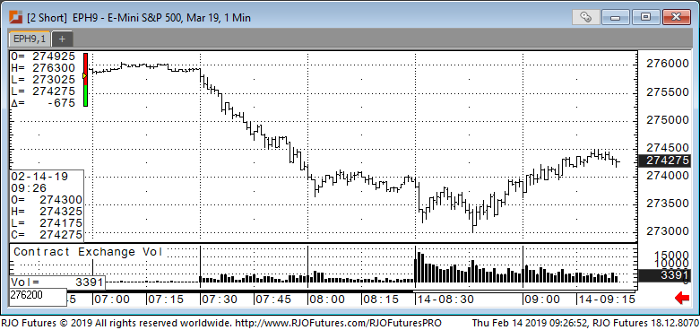

Key earnings after the close include Applied Materials and NVDIA. Look for support today 274000 and below at 273100 with resistance at 276000 and 277000.

If you would like to learn more about S&P 500 futures, please check out our free Trading E-Mini S&P 500 Futures Guide.

E-Mini S&P 500 Mar ’19 1 Min Chart