U.S. stock futures fell this morning on increased trading tensions with China and a record drop in retail sales. As the coronavirus continued to keep people at home and businesses shuttered, the U.S. Commerce Department released the record breaking drop in retail sales. With an anticipated 11.2% decline the actual number of 16.4% in April was the largest since 1992 when record-keeping was started. Sales numbers in March showed an 8.3% decline. Clothing was down an incredible 78.8%, a drop of 89% year to year, electronics 61% and gasoline almost 30%. Amazon was the only bright spot with an 8.4% increase. The U.S.-China trade relationship took a major step back As President Trump said he had no interest speaking to his Chinese counterpart and completely cutting ties with them remains on the table. “They should have never let this happen”, Trump said, “So I make a great trade deal and now I say this doesn’t feel the same to me. The ink was barely dry and the plague came over. And it doesn’t feel the same to me.”

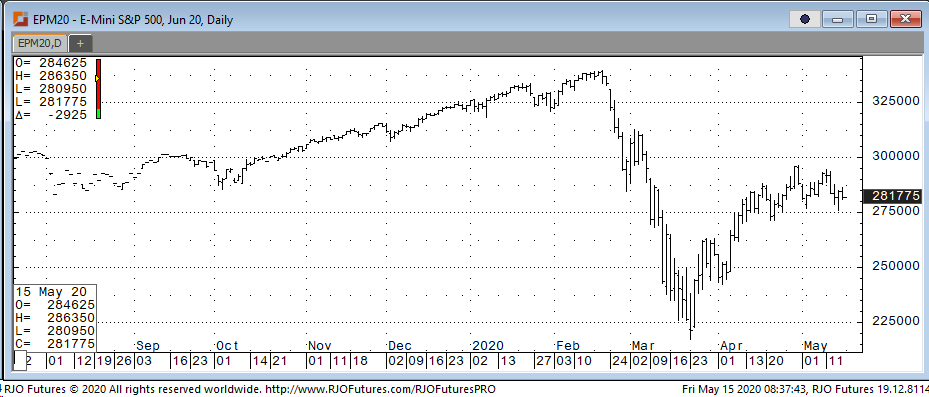

Support today is 282200 and 274500 with resistance showing 291500 and again at 293000.