U.S. stock futures were relatively flat Friday morning after Thursday’s sharp sell-off initiated by the high inflation number and an announcement of a 100-basis point increase to the Fed Rate by July. The Labor department released data on Thursday that showed a 7.5% increase in the consumer price index, a composite of the cost on everyday good, as opposed to the expected 7.2%. This was the highest reading since the first quarter of 1982. James Bullard, the St, Louis Federal Reserve Charmain, called for a 100 pt increase during the three regularly scheduled meetings before July with the first being in March. Most economist are predicting an aggressive 50-pt hike during that first meeting in March with a total of 150-pts for the year to curtail the rising inflation.

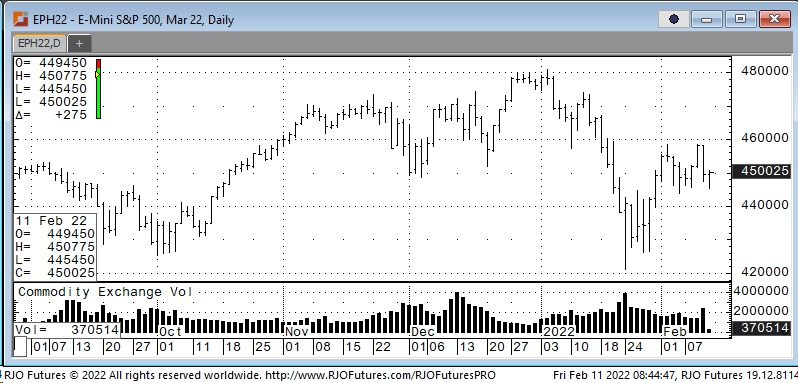

Support today is checking in at 443150 and 441000 with resistance showing 454000 and 461400.