U.S. stock index futures are trading higher today, this was helped by gains from top technology names including Apple, while traders were closely watching the jobs report for confirmation that the U.S. economy remains healthy. According to data released by the Labor Department this morning, the market for U.S. jobs closed the year on a down note, with payroll and wage growth for December missing expectations. Nonfarm payrolls rose by just 145,000 while the unemployment rate remained steady at 3.5%. Analysists surveyed by Dow Jones had been forecasting a job growth number of 160,000. The jobless rate met expectations for staying at a 50-year low. Adding to the slow payroll growth, average hourly earnings only rose by 2.9%, well below the 3.1% projection. December marked the first time that wage gains were below 3% on a year-over-year basis since July 2018. “After a strong 256,000 gain in payrolls in November, boosted by the return of 40,000 GM workers, some slowdown in the pace of job gains in December was inevitable,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note. Pearce characterized the job growth as “solid” even though it missed estimates and said, “we expect solid gains in payrolls to extend through 2020.”

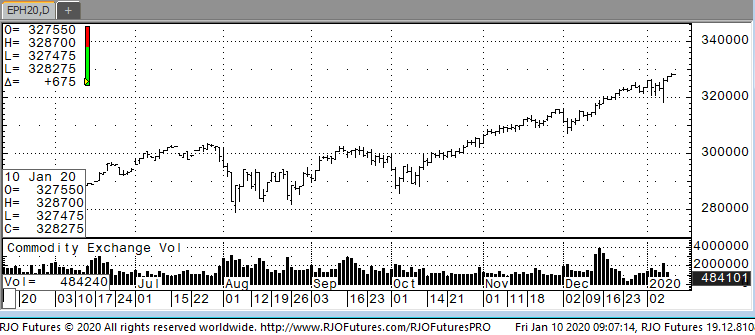

Support is checking in today at 326500 and 325100, while resistance is showing 328500 and 329000.