This morning has stock futures mixed, holding close to record highs as investors digested the Federal reserve’s decision to taper some of their monetary policies as the economy continues to recover. Tech stocks were higher, and the Nasdaq led the way on the major indexes. With the Fed’s latest monetary policy decision and the stronger than expected quarterly corporate earnings released on Thursday the S&P 500, Dow and Nasdaq set intraday and closing highs once again. Not to anyone’s surprise the central bank announced that it would begin tapering its asset purchase program starting this month. The Federal Open Market Committee members decided that the economy had made “substantial further progress” in recovery paving the way for removal of policy support. The next month will see a reduction in $15 billion in asset purchases and another $15 billion in December but they have added flexibility with the uncertainty around inflation.

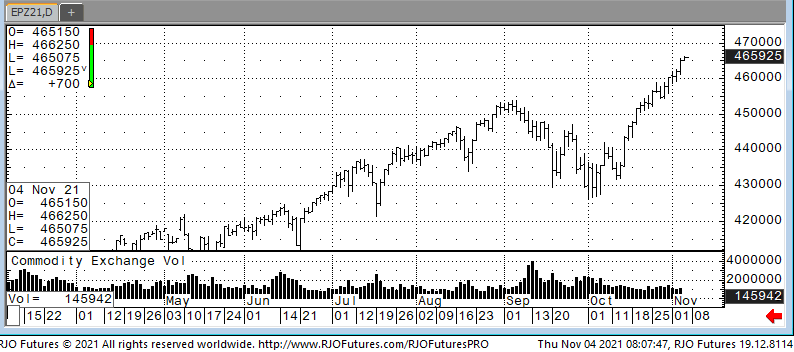

Support today is 462950 and 460000 with resistance at 467500 and 469000.