U.S. stock futures are trading lower this morning with the Covid-19 stimulus talks stalling once again. There were some positive signs that the bipartisan stimulus deal, roughly 900 billion, was going to pass but they could not reach an agreement on some aspects of the deal. The stimulus package has largely been priced in the market so any negative news should hit the market harder than a positive reaction to good news. “There is a nontrivial chance that we get a deal in the coming weeks,” said Jeff Mills the chief investment officer of Bryn Mawr Trust,” if it doesn’t come by late January, when the new congress is sworn in, then I think we could see markets starting to get a bit nervous.” Without this new stimulus package millions of Americans could lose their unemployment benefits starting the new year. Weekly jobless claims also increased to 853,000 this past week, the highest since Sept. 19th , as new lockdown orders took its toll on businesses from new corona virus cases.

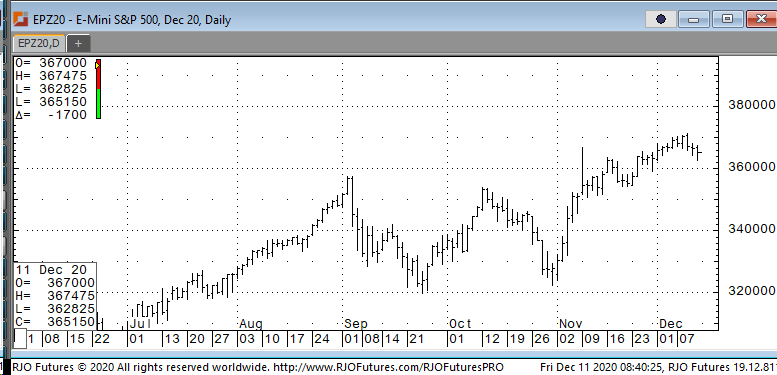

Support is checking in today at 364000 and 362000 with resistance showing 368000 and 370000.