U.S. stocks had a mixed open this morning after seeing the worst single session drop yesterday in three months. The Nasdaq continued its tech stock sell off while the Dow and S&P 500 rallied on a better than expected payroll number for August. The Labor Department released data this morning that showed an increase in nonfarm payrolls of 1.37 million in August and the unemployment rate dropped to 8.4% This was much better than the anticipated growth of 1.32 million jobs and a 9.8% rate. The August rate was the lowest it has been since the coronavirus shutdown in March. “We are still moving in the right direction and the pace of the jobs recovery seems to have picked up, but it still looks like it will take a while-and likely a vaccine-before we get close to where we were at the beginning of this year,’ said Tony Bedikan, head of global markets at Citizens Bank. “We continue to be optimistic that the economy has turned a corner and that we’ll continue to see steady progress.”

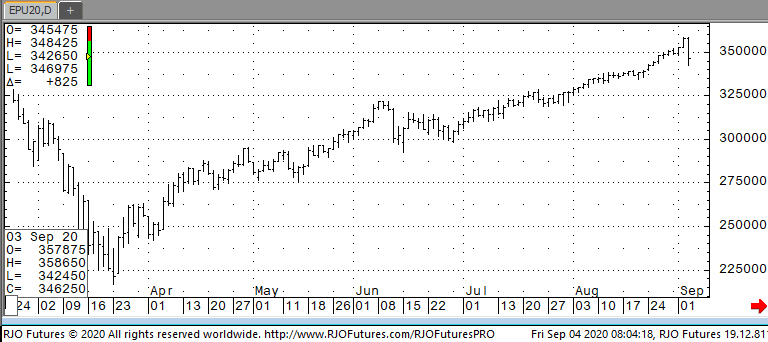

Support today is 277500 and 273000 with resistance at 354000 and 365000.