U.S. stock futures are mixed this morning as traders took in a key report on the labor market’s recovery. The S&P was down slightly a reversal from a third straight day of gains. The rally was part due to the Senate leaders reaching an agreement on raising the government borrowing limit into December, avoiding a default as early as this month. They voted to increase by $480 billion and it will head to the House of Representatives today. With the budget temporarily out of the way the focus was switched to the latest job report which showed another miss on payroll gains following a disappointing August number. Non-farm payrolls only rose by 194,000, missing the expected 500,000 number. The unemployment number fell more than expected to 4.8% but it was followed by a poor labor force participation rate of 61.6% versus 61.7% in August. Even with the payroll miss in September the report may still be strong enough to trigger a tapering from the Federal Reserve. Jerome Powell said it would only take a “reasonably good report” in September to meet the Fed’s threshold.

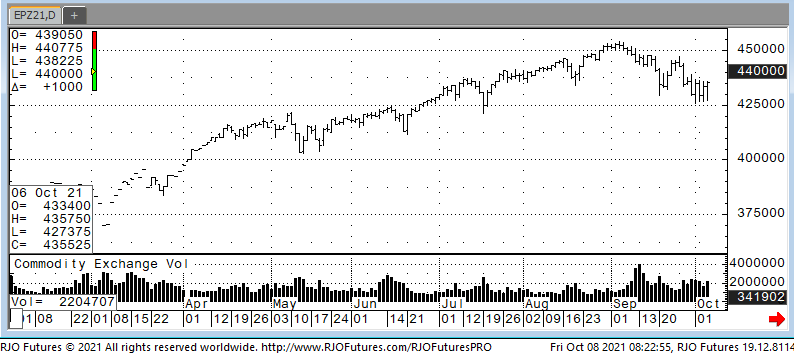

Support today is 435500 and 432500 with resistance at 442500 and 446000.