Global markets regained their footing over Wednesday night and took a positive tone coming into Thursday’s trading. There appears to be more optimism over US tax reform measures as the House is expected to bring a bill to vote this week, which provides a boost to risk appetites around the globe. While Chinese shares finished nearly unchanged, Asian stock markets were mostly higher, led by strong gains in the Japanese Nikkei and South Korean KOSPI indices. A busy morning of European data included a reading for Euro zone CPI and better than expected results for UK retail sales. The US trading session will start out with a weekly reading on initial jobless claims that is forecast to have a modest drop from the previous 239,000 reading. Will this recovery be enough to see a resumption of the uptrend? There are still some concerns that earnings growth may slow; especially if there is a long and drawn out fight over tax policy. Some form of tax relief is already priced for 2018 earnings and this may be enough to spark some movement of investors to the sidelines into the end of the year. December e-mini S&P resistance comes in at 257960 with support at 256425.

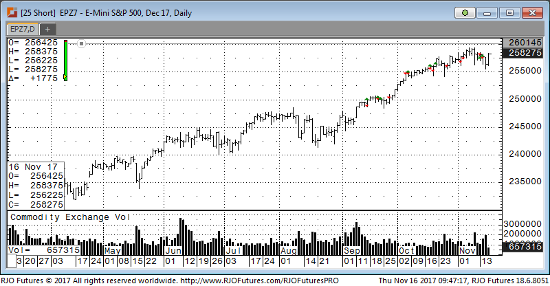

Dec ’17 Emini S&P 500 Daily Chart