By: Jeff Yasak

U.S. equites are pointed higher this morning, setting up the first weekly gain in a month. The drop in key commodity prices have relived some anxiety that the country might not be facing a full-fledged recession with the Federal Reserve tripping up the economy with rate hikes. This week saw oil prices hanging near the lowest levels since early May and copper, a closely watched indicator of manufacturing demand, has seen the worst week in more than 2 years. Jerome Powell, The Federal Reserve Chairman, spoke to Congress on Capitol Hill yesterday and stated that he and his colleagues “can’t fail” in their effort to bring inflation back to the 2% level. This is very much needed in the U.S. for price stability and points to more Fed rate hikes and a slower economic growth pattern. “We really need to restore price stability,” said Powell to the House Financial Services Committee. “Because without that we are not going to be able to have a sustained period of maximum employment where the benefits are spread very widely. It’s something that we need to do, we must do.”

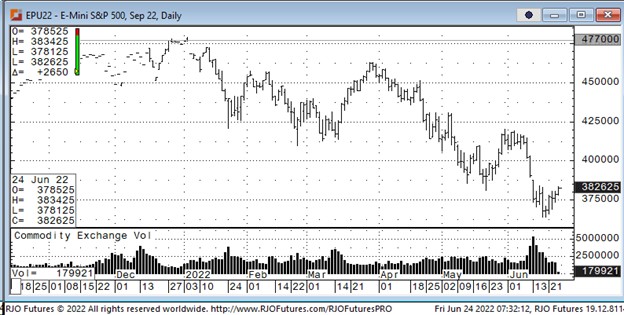

Support today is 375500 and 371000 with resistance showing 382600 and 385100.