Global stock markets were mostly lower overnight, led by Chinese equities declining nearly 1%. The June Nasdaq opened today at 7503.25 and has led U.S. equity futures lower during morning trade. Stocks are in a period of consolidation this week after last week’s massive move up being the largest of the year. Investors are searching for direction as global sentiment breaks down and scheduled data out of the U.S., Europe, and China has been soft lately, pointing at signs of a global economic slowdown. However, Friday morning’s data showed relative strength. Retails sales were up 0.5% m/m vs 0.3% growth last month, but still missing expectations. Industrial production beat expectations, gaining 0.4% m/m vs -0.4% last month. These figures are in the “middle of the road”, not strong enough to rally stocks, but not weak enough to cause more dovish Fed dialogue.

Last week’s rally was fueled by a dovish Fed. Stocks bounced hard off correction lows, attempting to price in the probability of 3 rate cuts in the back half of this year. With stocks near all-time highs, I believe this rally is a bit overdone. The probability of a rate cut in July has moved toward 80%. Markets are pricing in extreme dovishness in the back half of this year, but what if the Fed is not dovish enough? FOMC meeting minutes will be released next week, and if they hint that they will not cut rates in July, or perhaps that they won’t cut rate sharply enough, stocks could be pulled back into the grips of downside action. With utility funds at all-time highs, and analysts forecasting more slowing growth ahead, it begs the question; can central banks prevent recessions… or simply postpone them? One thing is clear – markets are feeling anxious and if the Federal Reserve dials back their level of dovishness, the recent rally is likely to falter.

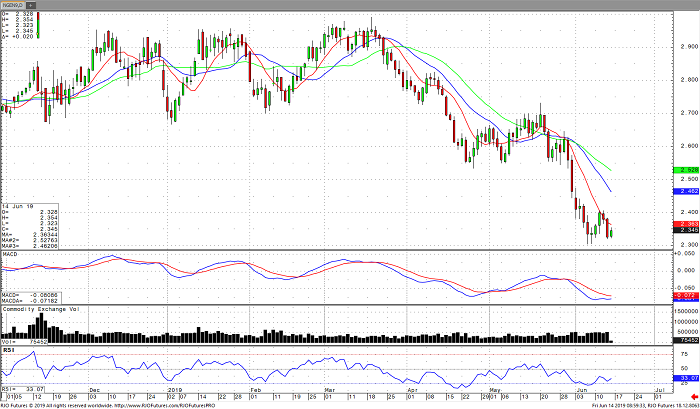

E-Mini S&P 500 Jun ’19 Daily Chart