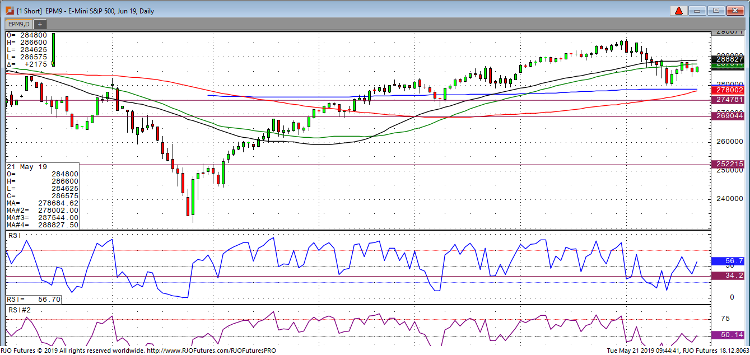

Stocks overnight and this morning have caught a bid on news that the U.S. has granted a 90-day temporary license to Huawei which many believe will lessen the friction between China and U.S. As I stated above, the market has bid today but can it last, my best hypothesis is no. There are still many uncertainties the market faces, the major one being the ongoing tariff conflict with China that does not seem to want to end any time soon. Another worry that must be presented is that as the U.S. continue to raise tariffs on China, they are not backing down whatsoever and does China retaliate by refusing to continue purchasing our debt. China is the biggest owner of U.S debt and if they do stop buying, the result could be catastrophic for the U.S. Rates would shoot very quickly that the Fed would be in a major bind immediately. So, this temporary license we gave Huawei in my opinion is just that, temporary. Traders should continue to watch headlines very closely as the market reacts swiftly and with very little notice. Let’s look at the technicals, even though the S&P is up 17$ today, the market is still in a downtrend until 2885 which would turn the trend as neutral. Today, I see the market possibly testing 2865-67 and should fail there. I think the overall mentality has changed from buy the dip to sell the rally. Again, traders should be very cognizant of any headlines that cross the tape that deals with China.

E-mini S&P 500 Jun ’19 Daily Chart