U.S. Stock futures are up this morning after a strong retail sales number and very promising news on a Covid-19 vaccine from Pfizer. According the U.S. Census Bureau “Advance estimates of U.S. retail and food services sales for September 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $549.3 billion, an increase of 1.9 percent (± 0.5 percent) from the previous month, and 5.4 percent (± 0.7 percent) above September 2019. Total sales for the July 2020 through September 2020 period were up 3.6 percent (± 0.5 percent) from the same period a year ago. The July 2020 to August 2020 percent change was unrevised at up 0.6 percent (± 0.2 percent). Retail trade sales were up 1.9 percent (± 0.5 percent) from August 2020, and 8.2 percent (± 0.7 percent) above last year. Non-store retailers were up 23.8 percent (± 1.6 percent) from September 2019, while building material and garden equipment and supplies dealers were up 19.1 percent (± 2.1 percent) from last year.”

Also, this morning, Pfizer Inc stated that is applying for emergency use of their experimental Covid-19 vaccine that they are co-developing with BioNtech SA. This could come as soon as the end of November. This is a bit longer than they had first anticipated but it will be filed once two months of safety data are compiled per FDA rules. This news had Pfizer shares trading up 53% in the premarket.

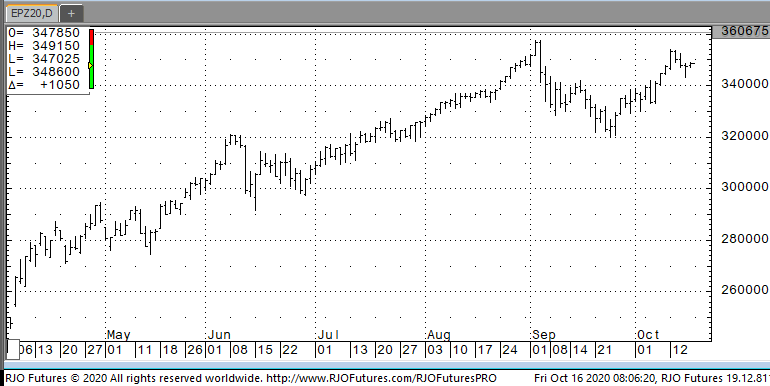

Support today is 345000 and 341500 with resistance showing 351000 and 352500