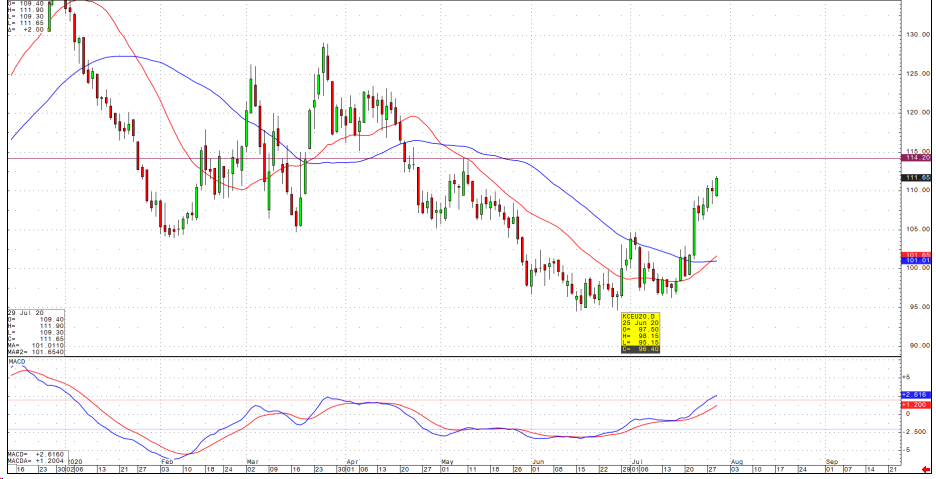

A cross of the 25-day MA up through the 50-day MA has sparked a strong rally in September coffee. We continue to hear reports of less wet weather in key growing areas of Brazil that had initially provided somewhat of a bearish outlook. As we continue to battle against COVID-19, stay at home coffee purchases continue to stay solid. September coffee prices are targeting the 115 level, and with a weakening U.S. dollar, we should likely see an inverse push higher on most commodities.

As several States continue to rollback their initial re-openings due to the spread of COVID-19, we need to be mindful that until we are fully operational and back to normal, sporadic and volatile price action will continue to take center stage in commodities. Until that day when restaurants are permitted increase their level of capacity (or even remain open), home coffee sales will not be nearly enough to offset the gaping void of demand left unfilled by restaurants and coffee shops. In addition, many of these restaurants and coffee shops may never return. From a technical perspective, we await a retest of the 115 level in order to see whether this rally may turn into a reversal up.