U.S. stock futures rallied off their lows Friday morning after the release of a stronger than expecting job report. The U.S. added 1.763 million jobs in July while economists were predicting a number in the 1.4 million area. The unemployment rate was also better than expected coming in at 10.2%. Revisions for the months of May and June were also higher on todays release. This positive news came when investors were eagerly waiting for lawmakers to come to an agreement on a new U.S. relief package. The negotiations were near a collapse Thursday as White House officials and Democratic leaders were no where close to making a deal and these positive numbers could ease pressures of a quick deal. “If this had been a bad number, it would have forced the negotiators to get a deal done.” Said Matt Maley, chief market strategist at Miller Tabak & Co. “So in a perverse way, the better-than-expected data raises the odds that nothing will get done soon on the fiscal front.”

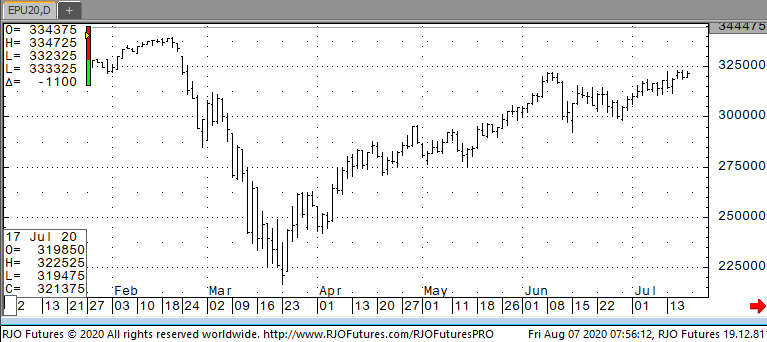

Support today is checking in at 332000 and 330000 while support is showing 336600 and 337500.