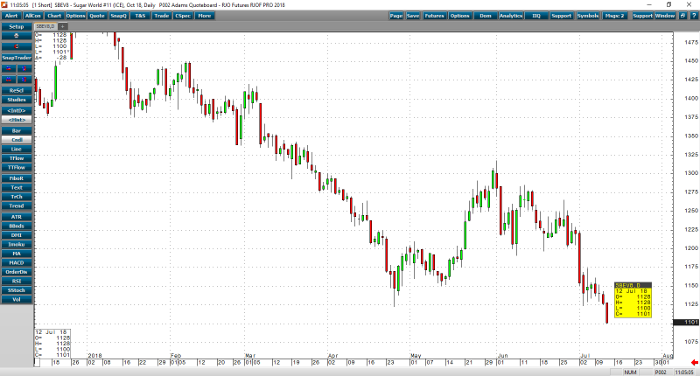

This week’s comment finds the sugar market in a familiar technical and fundamental situation. After dropping about 70 points from where we were before the July 4 holiday, the October sugar futures contract was again consolidating near the lows of the recent move, 11.24. As of July 3, the fund trader category was short almost 31k contracts. This leaves plenty of fire power or room for the funds to extend their short positions. Remember, in May of this year the funds were short over 170k contracts. News out of Brazil, highlighted in recent Hightower commentary, shows the use of sugar cane for ethanol is now upwards of 60% in the Center-South region and possibly increasing. This is a supportive factor and not insignificant. The more sugar cane is used for ethanol the less that will be left for sugar production and ultimately less for export. The challenge for sugar bulls is the sizeable global surplus that remains and looks to continue into next year and possibly the next. Technically, the sugar market is oversold. The chart still looks heavy and one could guess that in the October sugar futures contract new lows for the move are likely to happen before a move back to the 18-day moving average, 11.94. Without a new fundamental input, it is difficult to see what might allow for a sustained rally. The 18-day moving average comes in fully 84 points overhead in the October contract, 11.87. Sugar is carving out new lows on lower volume and bounces should not surprise. But traders will likely view any move higher as an opportunity to add to profitable positions or enter new short trades.

Sugar Oct ’18 Daily Chart