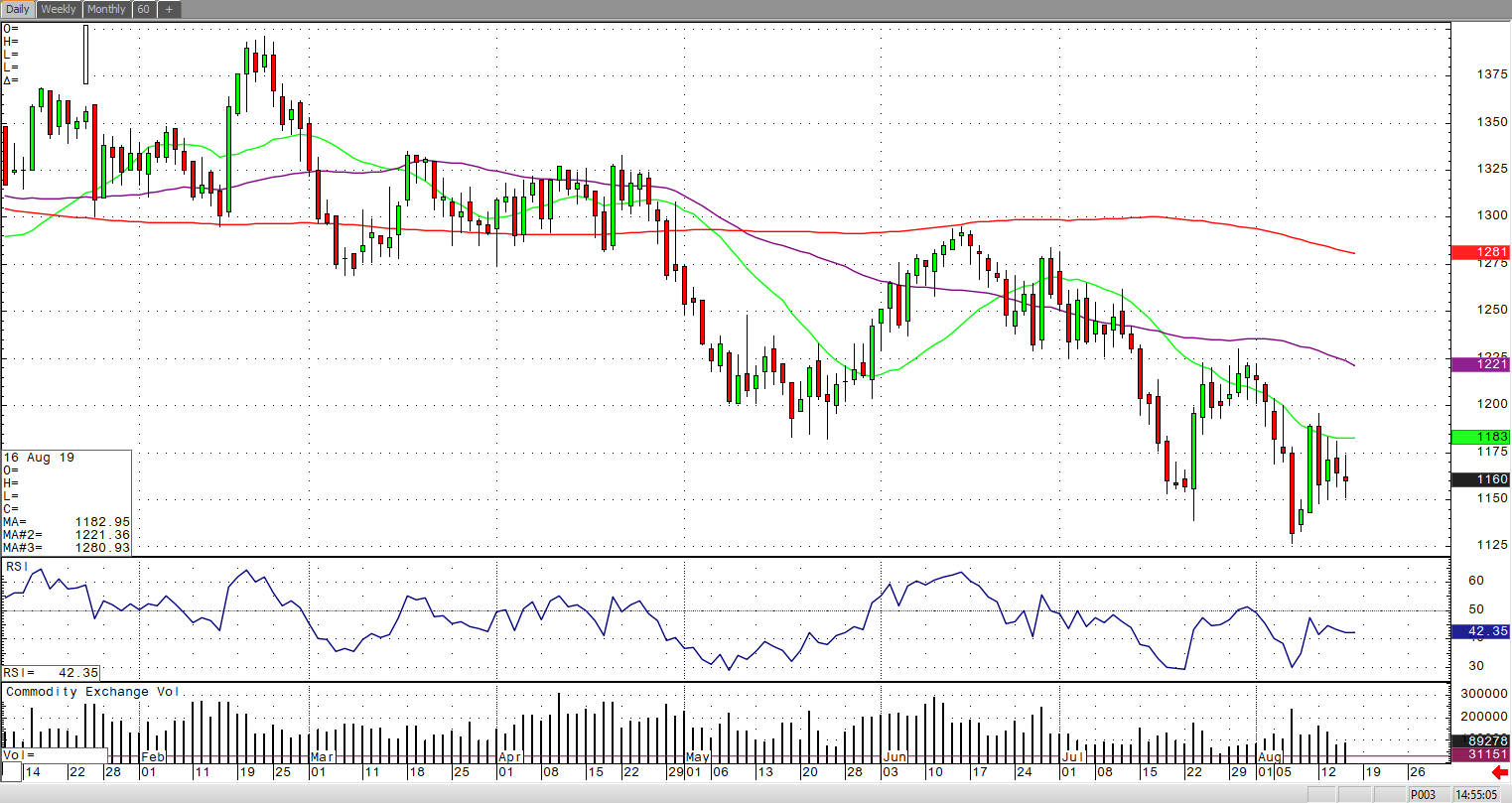

This week’s comment finds sugar consolidating below the moving averages and the most recent swing high. Outside market weakness has surely weighed on sentiment. The constant barrage of bullish prognostications from large commodity concerns and producer unions has recently been unable to lift sugar over the 18-day moving average, at least not for very long. The size of the fund short position, which we will find out about with Friday’s release of the COT, should be just shy of 100k. There is room for the funds try to push this market lower. The question might be, however, is there a fundamental catalyst for new lows?

As volatility increases across commodity and stock index futures markets the October sugar futures contracts may be settling in for late summer doldrums. In their comment from morning lead, The Hightower Group had October sugar futures turning a blind eye to the excitement in crude oil and currencies. Crude contracts were down over 2-full points and sugar was off only 11-ticks from open to close? This could be a prelude to aggressively sideways price action until the market is presented with new information. 12.19 and 12.63 beckon overhead as risk levels trend followers will use to exit current short positions. Interesting to note that those levels are not profitable exits yet for the trend following models we track. Summertime is not usually kind to trend followers and these short positions should be viewed with suspicion. A short covering rally could erupt at any moment. But, at the end of the day, should production challenges and deficit projections begin to fade it will be difficult for sugar to avoid new lows.