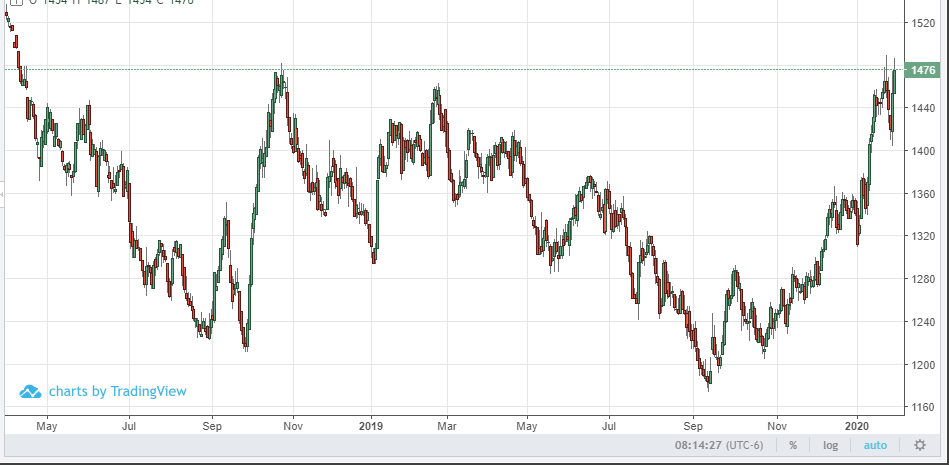

Mar ’20 sugar futures offered a very bullish signal Tuesday by hammering down taking out previous lows, spiking up taking out previous highs and ultimately closing positive. Wednesday we see sugar prices follow through on this bullish activity pushing prices higher again in what looks like a resumption of the ongoing rally supported by the expected massive global production deficit, and the sell-off we saw likely helps correct concerns of being overbought. At the time of writing, sugar is trading near a resistance point and will need to push higher and close above 14.77 to really prove the rally is back on. It’s possible to see some volatility as China is a major purchaser of this commodity, and like many other markets there is concern over near-term demand from Asia. This is still a very bullish market and my analysis suggests strong fundamentals are still in place and support from rebounding oil prices should be enough to put the sweet sugar ride back on track to more gains.

For a free consultation call my direct line at (312) 373-4875 or send an email to escoles@rjofutures.com.