This week’s comment finds the October sugar futures contract carving out new lows for the move. In our last comment, we asked what fundamentals could emerge that might drive prices lower. The record production from India last year still must find a home as mentioned in this morning’s Hightower report. They suggested that India will subsidize exports and this is weighing on the market. Also mentioned was Mexico and new trade agreements with the U.S. The result of the new agreement being Mexico will have upwards of 500,000 tonnes of sugar that will also have to find a home as they will not be shipping it into the U.S.

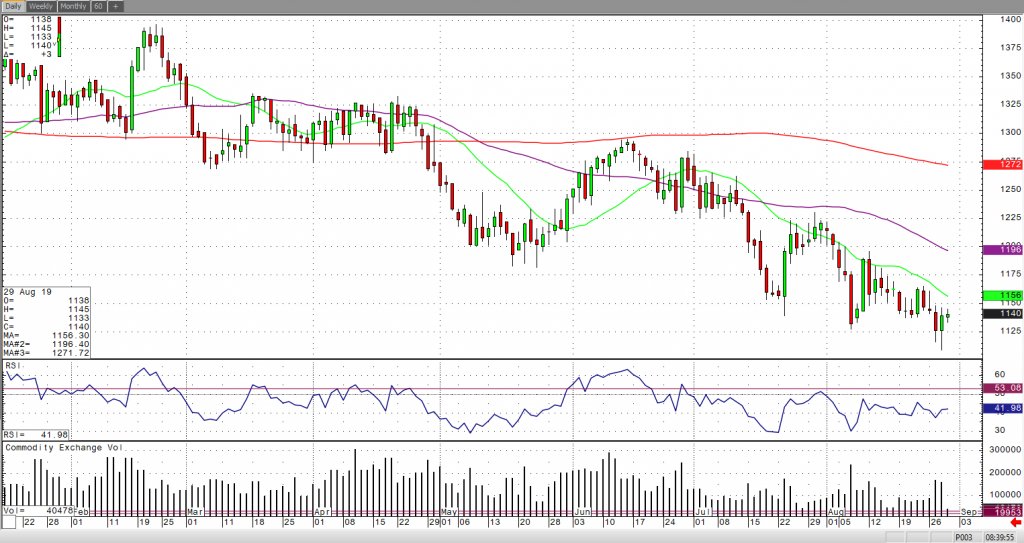

While the wire services have done a great job of bringing us new bearish fundamentals this week, today’s price action was more like sell the rumor buy the fact. After making new lows early in the session, sugar managed to close near yesterday’s high. This could be an early sign that bearish developments are now baked into our sugar cake. Overall, the trend is down. It has been my assertion, that as we moved further into the year and projections for deficits in production were met with ample supplies of sugar, up front price would continue to erode. The October contract remains just below the 18-day moving average, 11.54. Closes over the 18-day will likely signal the market is done going down for now and may need to consolidate in a range between 11.20 and 11.80. It is still summer. The Fund trader is short over 150,000 contracts. This is not a record, and there is room for more selling by the Funds. But, traders who are short should watch price action carefully to see if October stops reacting to bearish news. This is the time of year where a short short-covering rally could travel a lot of distance with very little fundamental fuel.