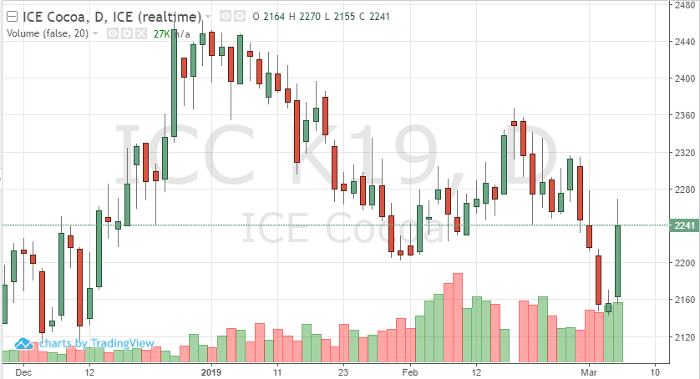

After three big down days, May cocoa looks to have reversed. 2140 and 2160 held and prices enticed buyers back in Wednesday. A 115-point trading range occurred, and the market closed 84 points up. Most of the bounce came from technicals – although an increased European demand outlook may be coming. With the ECB meeting ahead of us, positive news could lead to a stronger euro which could help cocoa. Dry weather, accompanied with heat could also hurt production. This could also boost prices higher in the further out trading months. After talks of the potential record production levels for the 19/20 calendar year, these recent weather fronts could curb that. Mixed news is also keeping prices rangebound as traders anticipate higher supply levels in Ivory Coast but lower levels in other key growing regions like Brazil and Indonesia. These pending factors will continue to add to cocoa’s volatility and could have this contract headed to 2300 or 2000 by the roll in April.

Cocoa May ’19 Daily Chart

If you would like to learn more about soft futures, please check out our free Fundamental of Softs Futures Guide.