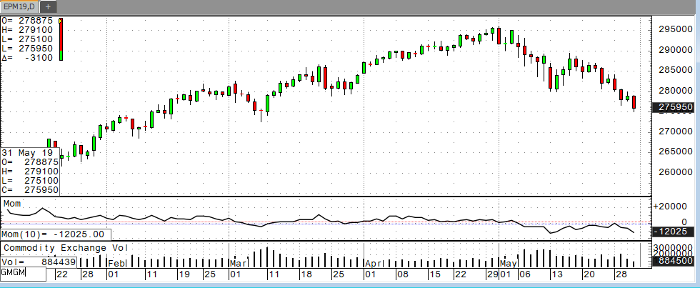

The E-mini S&P opened at 2788.75 on Friday and has moved lower in morning trade, and the other indices have made similar moves. Today’s action can likely be attributed to President Trump’s proclamation that the U.S. is going to impose tariffs of 5% on all goods imported from Mexico. Mixed scheduled data this morning is not doing anything to support markets, with an uptick in personal income (0.5% growth vs 0.1% prior) counterbalanced by a larger decrease in consumer spending (0.3% growth vs 1.1% prior). Global sentiment currently has a “risk-on” attitude. Illustrating this point is that equity markets worldwide were lower overnight, apart from the Australian market clawing higher. Lack of progress with China on trade is causing a market overcast as well. With rapidly diminishing sentiment in the short-term, and hope growing for a rate cut by the Federal Reserve later in the year, there is reason to believe a bottom may not yet be in place. Momentum clearly favors the bear camp, particularly with the Russel index, whose technical indicators have not signaled “bullish trend” since February. With a plethora of negative geopolitical events, the question is not over the direction of equity prices, but rather the magnitude of the downward shift. For now, downside support in the June S&P is seen at 2753, while upside resistance is observed at 2801 in the event of a bounce.

E-Mini Jun ’19 Daily Chart