There were few big moves on the US indices or commodities this week, but rather more of a consolidation. This could lead to fresh moves this week if breakouts occur. And as there is no reduction in the threat of COVID-19 yet – and therefore no active economy to get back to – it’s possible the indices may break lower in the coming days.

Precious metals also consolidated for several days, although Gold’s price action appears more bullish than bearish and may break out to the upside in the near future.

Light Sweet Crude Oil (CL), 4-hour, Bullish

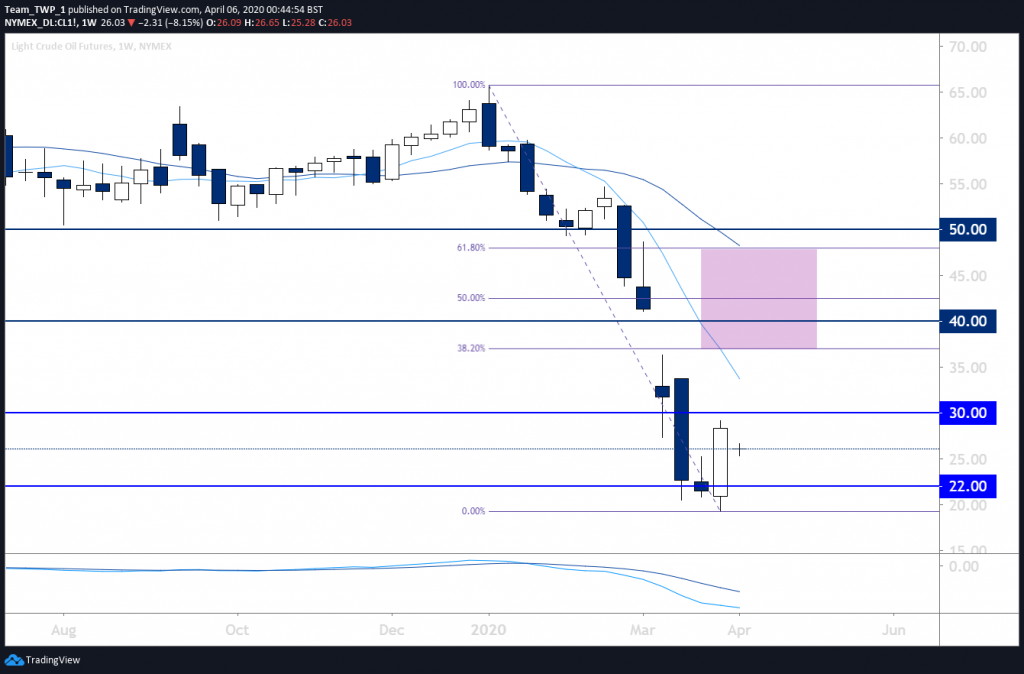

Oil has become technically over-extended on the monthly and weekly time frames at significantly low levels. On the daily timeframe, there is clear bullish divergence between price and the MACD indicator, which may imply that price could change trend.

The weekly chart has confirmed a swing low, with price now heading up towards the moving averages (MAs).

Measuring a Fibonacci retracement from the weekly highs creates 61.8%, 50% and 38.2% at $48.00, $42.50 and $37.00 levels respectively. It isn’t unreasonable that there could be a price retracement on this timeframe back up to at least the 38.2% this week.

There are also significant support and resistance levels at the $30, $40 and $50 price levels, so price may attempt to head up to 40, which is just below the 50% Fib level.

The area in the chart below highlighted in purple represents the area of resistance between the 61.8% and 38.2% percent levels.

The daily chart has not yet created a technical uptrend with higher-highs and higher-lows, but the four-hour chart has.

There may be more than one opportunity for traders on this timeframe if price trends consistently up towards the $40 price level or higher.

In each case, should price retrace down into the MAs (in this chart they are 8 & 21 simple MAs), and produce a small bullish candlestick, there may be an entry opportunity should the move create a fresh bullish extension.

Areas highlighted in green represent examples of pullbacks where entries could be found. They may be even more technically attractive should they overlap with four-hour Fibonacci retracement levels and more importantly significant S/R levels, as well as traditional pivots.

Entry orders could be placed above the high of these bullish candlesticks, with stop-losses either below prior swing-lows or more aggressively below the bullish candlestick itself.

Risk management will continue to be a key given the volatile nature of the markets currently, so a stop-loss is imperative in order to protect capital exposure against unforeseen outcomes.